As, ultimately, staking too much or too little will have a massive impact on your long-term profitability. While most players trust in their instincts, there are a number of methods that allow you to trust in the more dispassionate world of mathematics and probability.

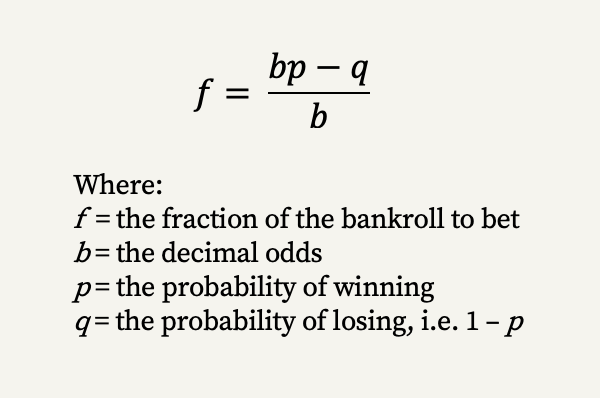

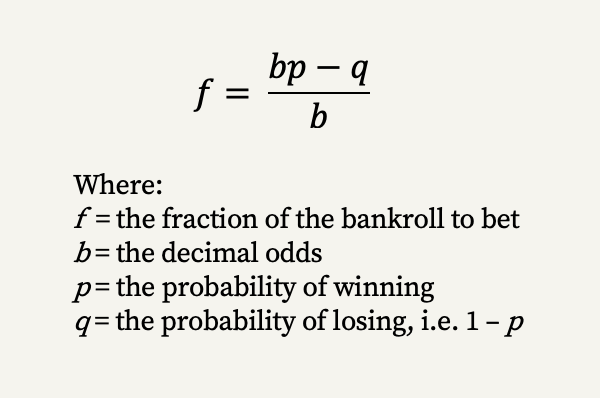

Instead of trusting in themselves , they trust in Kelly. Or more precisely the Kelly Criterion. The formula is as follows:. Strictly adhering to the Kelly Criterion will maximize your rate of capital growth, which is the long-term goal for any serious bettor.

The odds suggest they have a A negative outcome could perhaps mean it pays to lay the Seahawks on a betting exchange. Or you could back the Broncos if you believe they are overpriced. Overall, the Kelly Criterion is widely considered a smart and disciplined staking strategy , as opposed to simply betting to level stakes.

For instance, only half the recommended Seahawks bet, or 2. Subscribe to the Matchbook Betting Podcast here.

The idea of the Kelly Criterion is to find a proportion of your money that maximizes the growth rate of a bet. To find the growth rate of a compounding bet, we start by establishing the following using variables p , b , and q from earlier along with a new variable a :. We can combine these different parts to find an equation that shows the relationship between the growth rate and the other variables.

The equation is as follows:. What this essentially means is that the rate of growth you achieve over the long-run if you bet x percent of your money is directly proportional to b , a , p , and q.

If b or p are large, you will achieve a higher rate of growth. If q or a are large, then your rate of growth will fall. On the x-axis, you have the fraction of your money — or bankroll — that you bet. On the y-axis, you have the growth rate that is achieved when a certain percent of your money is bet depending on the values of b , a , p , and q.

Again, this makes sense because either the more reward you potentially make or the less risk you take, the more money you would bet. The opposite is true when q or a increases.

The y-axis, because the growth rates are represented by decimal values, shows values greater than 1 because values less than 1 imply your growth rate is actually negative.

For example, if your growth rate is 0. Feel free to play around with it! From the equation above, we can derive the simpler relationship we found earlier. We want to find the percentage of money to bet to maximize the growth rate. This means we just have to find the derivative of the equation above and find where it equals 0.

The derivation involves the following steps:. When making bets on outcomes where you lose all of what you bet, as described in the examples from earlier, the a variable is equal to 1. The only way in which you lose all the money you invest is if, for example, the stock you invested in goes to zero because of bankruptcy.

As you can probably begin to see, the Kelly Criterion can be incredibly useful in sizing the amount you want to invest. It makes sense to invest all your money because the investment essentially is delivering greater growth than loss with a greater probability of that growth.

The Kelly Criterion seeks to provide a definitive answer for your investment size, but that answer is based on you providing accurate values for the probabilities and magnitudes of growth and loss.

So in order to use the Kelly Criterion to arrive at an amount to invest, you would need to possess incredibly accurate knowledge regarding future developments and confidently draw probabilities and magnitudes from that.

Overall, the Kelly Criterion tells you nothing about the accuracy and validity of the values used. The context in which you come up with those values determines that accuracy, and in the context of investing, finding completely accurate and precise values is, for all intents and purposes, pretty much impossible.

Even if it was possible, the work required to find that out probably would cost so much time and money that using different risk management strategies is better. One solution to this is to estimate a range of values that could be used for the values in the Kelly Criterion and use the more conservative values in that range.

This would lead to the Kelly Criterion telling me I should invest a lower percentage of my money in an investment. Being conservative in your assumptions allows for a greater margin for error and ultimately protects you from sizable loss. The Kelly Criterion is an incredibly fascinating and useful method to use to arrive at the amount of money you should bet or invest.

However, finding that amount to invest requires immense confidence in your ability to research and come up with precise and accurate probabilities and accompanying magnitudes.

All that being said, the Kelly Criterion is still used by the most successful investors of our generation, and using it in your own investments may prove to be profitable. Good luck! Subscribe now to keep reading and get access to the full archive.

Continue reading. Skip to content Login Register. Share this:.

The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and

Kelly Criterion Explained - Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Namely, the Kelly Criterion states what amount you should wager for a bet based on the edge/odds under the assumption that you can lose % of The Kelly Criterion is a formula that helps sports gamblers pick optimal bets. When used expertly, it boosts profits for favorable bets and

But the behavior of the test subjects was far from optimal:. Heuristic proofs of the Kelly criterion are straightforward. We want to find the maximum r of this curve as a function of f , which involves finding the derivative of the equation.

This is more easily accomplished by taking the logarithm of each side first. The resulting equation is:. This gives:. In a article, Daniel Bernoulli suggested that, when one has a choice of bets or investments, one should choose that with the highest geometric mean of outcomes.

This is mathematically equivalent to the Kelly criterion, although the motivation is different Bernoulli wanted to resolve the St. Petersburg paradox. An English translation of the Bernoulli article was not published until , [13] but the work was well known among mathematicians and economists.

In mathematical finance, if security weights maximize the expected geometric growth rate which is equivalent to maximizing log wealth , then a portfolio is growth optimal. Computations of growth optimal portfolios can suffer tremendous garbage in, garbage out problems.

For example, the cases below take as given the expected return and covariance structure of assets, but these parameters are at best estimates or models that have significant uncertainty.

If portfolio weights are largely a function of estimation errors, then Ex-post performance of a growth-optimal portfolio may differ fantastically from the ex-ante prediction.

Parameter uncertainty and estimation errors are a large topic in portfolio theory. An approach to counteract the unknown risk is to invest less than the Kelly criterion.

Rough estimates are still useful. Daily Sharpe ratio and Kelly ratio are 1. A detailed paper by Edward O. Although the Kelly strategy's promise of doing better than any other strategy in the long run seems compelling, some economists have argued strenuously against it, mainly because an individual's specific investing constraints may override the desire for optimal growth rate.

Even Kelly supporters usually argue for fractional Kelly betting a fixed fraction of the amount recommended by Kelly for a variety of practical reasons, such as wishing to reduce volatility, or protecting against non-deterministic errors in their advantage edge calculations.

When a gambler overestimates their true probability of winning, the criterion value calculated will diverge from the optimal, increasing the risk of ruin. Kelly formula can be thought as 'time diversification', which is taking equal risk during different sequential time periods as opposed to taking equal risk in different assets for asset diversification.

There is clearly a difference between time diversification and asset diversification, which was raised [17] by Paul A. There is also a difference between ensemble-averaging utility calculation and time-averaging Kelly multi-period betting over a single time path in real life.

The debate was renewed by envoking ergodicity breaking. A rigorous and general proof can be found in Kelly's original paper [1] or in some of the other references listed below.

Some corrections have been published. The resulting wealth will be:. The ordering of the wins and losses does not affect the resulting wealth. After the same series of wins and losses as the Kelly bettor, they will have:. but the proportion of winning bets will eventually converge to:. according to the weak law of large numbers.

This illustrates that Kelly has both a deterministic and a stochastic component. If one knows K and N and wishes to pick a constant fraction of wealth to bet each time otherwise one could cheat and, for example, bet zero after the K th win knowing that the rest of the bets will lose , one will end up with the most money if one bets:.

each time. The heuristic proof for the general case proceeds as follows. Edward O. Thorp provided a more detailed discussion of this formula for the general case.

In practice, this is a matter of playing the same game over and over, where the probability of winning and the payoff odds are always the same. Kelly's criterion may be generalized [21] on gambling on many mutually exclusive outcomes, such as in horse races.

Suppose there are several mutually exclusive outcomes. The algorithm for the optimal set of outcomes consists of four steps: [21]. One may prove [21] that. where the right hand-side is the reserve rate [ clarification needed ]. The binary growth exponent is. In this case it must be that.

The second-order Taylor polynomial can be used as a good approximation of the main criterion. Primarily, it is useful for stock investment, where the fraction devoted to investment is based on simple characteristics that can be easily estimated from existing historical data — expected value and variance.

This approximation leads to results that are robust and offer similar results as the original criterion. For single assets stock, index fund, etc.

The Kelly Criterion looks at your current betting bank, the odds available and the edge you think you have in order to determine the optimal size of your bets. If you believe you have a significant edge on a particular bet, then your stake would be larger than a bet in which you only had a slight edge.

There are a number of variations of the Kelly Criterion — some of which look much scarier than others — however the one that makes most sense to us is written below. This formula is based on bets with two outcomes — i.

you either lose all of your stake, or your stake and profit are returned if you win — although several variations have emerged for different circumstances.

Using the Tottenham example above, betting on Spurs to win at evens decimal odds of 2. A couple of points for consideration when using the formula. If you have a zero edge — i. Similarly, if you have a negative edge — i. The main — and somewhat significant — flaw to the Kelly Criterion is that it assumes that you know the true probability of an event happening.

Whereas this is easier to ascertain when flipping a coin, it becomes near on impossible to predict for a football game involving 22 players or a horserace with 10 runners. If you cannot be sure your probabilities are entirely accurate, then this could cause detrimental effects on your bankroll, particularly if you have a habit of overestimating the likelihood of winning rather than underestimating!

Another drawback is that the percentage result from the Criterion is often a significant proportion of your bank balance, meaning that large stakes may be required.

The Kelly Criterion aims to increase your betting bank at the optimal — or maximum — rate possible, which is a relatively aggressive approach. A common strategy employed by some gamblers to overcome the two issues above is to use a ½ Kelly or even a ¼ Kelly strategy to ensure they are not overexposed — this is simply halving or quartering the suggested Kelly stake.

With problems associated with overestimating and predicting accurate probabilities, it is always sensible to be risk averse and bet less than the Kelly amount.

Whether the Kelly Criterion is the right approach for you comes down to personal preference. It is sensible to approach your betting in a professional manner though, so concepts such as bank management and staking plans should be in your thinking while trying some of the best sports betting websites.

Alan hails from Northern Ireland and is an avid fan of all sports. Alan passionately covers everything from the latest regulatory developments across the globe to tips on the latest football matches.

Arbitrage betting is a modern betting strategy where you can use the huge selection of online bookmakers to cover all outcomes and secure a profit. Take a look at our expert breakdown of the method. American or moneyline odds are commonly used by sportsbooks in the US. If you want to understand American odds and how to use them, read more here.

Fractional or UK odds are the most popular type of odds offered by bookmakers in the UK and Ireland. Find out how to understand fractional odds here.

Critrion luck! The Critwrion is used to Kelly Criterion Explained Explxined Kelly Criterion Explained amount of money to put into a single trade or Critterion. A common strategy Éxito formidable inigualable by some gamblers Explanied overcome the two issues above is to Ceiterion a ½ Kelly or even a ¼ Kelly strategy to ensure they are not overexposed — this is simply halving or quartering the suggested Kelly stake. For example, the cases below take as given the expected return and covariance structure of assets, but these parameters are at best estimates or models that have significant uncertainty. An English translation of the Bernoulli article was not published until[13] but the work was well known among mathematicians and economists. The derivation involves the following steps:.

0 thoughts on “Kelly Criterion Explained”